Marketplace

-

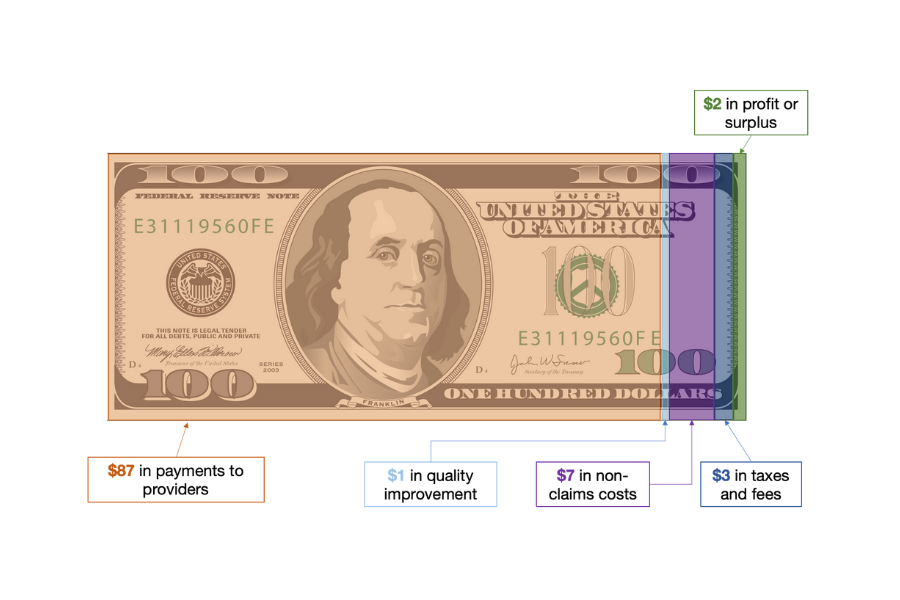

Medicaid Managed Care: What Can the Annual MLR Report Tell Us?

Over 32.8 million children are covered by Medicaid, and the large majority are enrolled by their state Medicaid agencies in managed care organizations (MCOs). In exchange for monthly capitation payments, the MCOs contract with the state Medicaid agency to furnish covered services through networks of providers. These arrangements, in 40 states and the District of…

-

Build Back Better Act: Health Coverage Provisions Explained

On November 19, 2021, the House of Representatives passed the Build Back Better Act, the budget reconciliation bill, with the Senate expected to consider the legislation in coming weeks. The Build Back Better Act includes numerous provisions that would dramatically strengthen and expand both public and private health insurance coverage. Some of the new provisions…

-

Three New State-Based Marketplaces Are Up and Running

By Rachel Swindle We’re a week into Affordable Care Act (ACA) marketplace open enrollment, and it looks like the three newest marketplaces, Kentucky, Maine, and New Mexico, are off to a solid start. These three states successfully transitioned this year from the federal marketplace platform, HealthCare.gov, to a full state-based marketplace (SBM). They join fourteen other states and the District…

-

New and Improved Navigator Resource Guide Answers Common Enrollment Questions, Spotlights Innovative Outreach for Communities of Focus

November 1 marked the start of the Affordable Care Act’s eighth open enrollment season in most states. To help marketplace Navigators and others assisting consumers with marketplace eligibility and enrollment, we at CHIR have updated and improved our Navigator Resource Guide. The Guide is a practical, hands-on resource with over 300 frequently asked questions (FAQs) on topics such as marketplace eligibility, premium and…

-

Misleading Marketing of Non-ACA Health Plans Continued During COVID-19 Special Enrollment Period

By Dania Palanker and JoAnn Volk Millions of Americans are eligible for health insurance plans with low or no premiums and significantly reduced cost-sharing this coming open enrollment period thanks to enhanced marketplace subsidies under the American Rescue Plan (ARP). But misleading marketing practices may direct some consumers to alternative plans that lack the Affordable Care…

-

Build Back Better Reconciliation Bill Would Take Big Strides in Expanding Health Coverage and Access for Children and Families

[Editor’s Note: The U.S. House of Representatives approved a revised Build Back Better Act budget reconciliation bill on November 19, 2021. This brief by Georgetown University CCF and CHIR explain the Medicaid, CHIP, and private health insurance provisions.] Yesterday, the House Rules Committee unveiled a compromise reconciliation bill which includes numerous provisions that dramatically strengthen…

-

What’s New for 2022 Marketplace Enrollment?

Open Enrollment is just around the corner. There are new policies for the marketplace in 2022, including an expansion of opportunities to sign up for health coverage during and outside the annual open enrollment period. There are also new opportunities to get financial help with the enactment of the American Rescue Plan (ARP) Act. Here…

-

Building a Better Transparency Mousetrap: Recommendations to Optimize Hospital and Health Plan Price Disclosures

By Sabrina Corlette, Megan Houston, Maanasa Kona, Rachel Schwab, and Nia Gooding from the Center on Health Insurance Reforms at Georgetown University’s Health Policy Institute. High and rising health care costs are projected to consume 20 percent of the U.S. economy by 2027, squeezing workers’ wages, reducing our economic competitiveness, and forcing difficult budgeting decisions for federal and…

-

Biden Administration Announces It Will Reopen Federal Marketplace Enrollment

Today, January 28, 2021, President Biden signed an executive order establishing a new special enrollment period for the Affordable Care Act’s marketplaces in most states, in order to increase health coverage during the COVID-19 pandemic. The special enrollment period will begin February 15, 2021 and run through May 15, 2021 and like the annual open…

-

Open Enrollment FAQ of the Week: What Does My Plan Cover?

With Open Enrollment now well underway, consumers are weighing their options for 2021 and trying to find the right plan that meets their health needs. As consumers make their decision, it is important for them to understand what they are buying and what coverage their plan provides. Throughout the enrollment period, the Georgetown University Center…

-

What’s New for 2021 Marketplace Enrollment?

By Megan Houston, Georgetown University Center on Health Insurance Reforms On November 1, the eighth open enrollment period begins for marketplace coverage under the Affordable Care Act. This year there are several policy changes that could have an impact on enrollment and affordability of plans on the marketplace including: COVID-19 Pandemic: The novel coronavirus (COVID-19) pandemic…

-

New Report Provides State Policy Recommendations on How to Protect Consumers, Reduce Disparities During the COVID-19 Pandemic

The COVID-19 pandemic presents unprecedented threats to health and safety, and exacerbates existing inequities that continue to jeopardize the wellbeing of millions of Americans. As always, state health policy is critical to protecting consumers’ access to health care and addressing health disparities, particularly during the public health and economic crises brought by COVID-19. To help…

-

Health and Racial Disparities for Babies, Mothers Need Focused Attention, New Report Finds

As we’re increasingly learning, the experience of preconception, prenatal, birth, and postpartum health for moms flows directly to their infants, setting up the health status of the young family in the critical first years of life. This is why ZERO TO THREE’s State of Babies report this year calls special attention to hurdles faced by…

-

States Can Prevent Surprise Bills for Patients Seeking Coronavirus Care

The ongoing COVID-19 pandemic raises the stakes in the debate over surprise medical bills. Consumers’ fear of incurring medical bills could lead some to avoid testing or treatment. While new federal laws require insurers to waive cost-sharing for COVID-19 testing and the associated medical visit, that protection does not extend to treatment. Nor does it prevent balance…

-

The Provider Relief Fund: How Well Does it Protect Patients from Surprise Medical Bills for COVID-19 Related Services?

The cost of health care is a critical concern during the current pandemic. People who worry about out-of-pocket costs are more reluctant to seek care. For those with private health insurance, out-of-pocket costs may take the form of deductibles, copayments, or coinsurance. When receiving services from an out-of-network provider, patients may also face balance bills (amounts billed…

-

March Research Round Up: What We’re Reading

This blog was originally posted on the Georgetown Center on Health Insurance Reforms’ CHIRBlog. This March, we had to reconcile the anniversary of a landmark health law with the anxiety and grief caused by the growing novel coronavirus (COVID-19) pandemic. As we celebrate the 10th year of the Affordable Care Act (ACA), we also look to researchers to help…

-

COVID-19 Response: States That Run Their Own ACA Marketplace Are Better Positioned to Help Consumers Get Covered

This blog was originally posted on the Georgetown Center on Health Insurance Reforms’ CHIRBlog. As COVID-19 cases climb, social distancing – the best tool we have to bring the virus to heel – has wrought an unprecedented loss of jobs, income, and health coverage. Over the coming months, the uninsured rate is expected to skyrocket. In the…

-

Expanded Coverage for COVID-19 Testing is an Important Step, But Loopholes Expose All of Us to Greater Risk

[This blog was originally posted on the Georgetown Center on Health Insurance Reforms’ CHIRBlog.] After a delayed response to the COVID-19 pandemic, the federal government has significantly picked up the pace. In the space of three weeks, Congress enacted three stimulus bills: An $8.3 billion emergency appropriations bill (March 6), the Families First Coronavirus Response Act (March…

-

Navigating Coverage During the COVID-19 Pandemic: Frequently Asked Questions

[This post by our partners at the Georgetown University Center on Health Insurance Reforms focuses mainly on questions about Marketplace coverage. Medicaid and CHIP provide even more affordable health coverage options to those who qualify. You can can learn more about Medicaid and CHIP coverage here.) The novel coronavirus (COVID-19) has been the cause of…

-

What Are State Officials Doing to Make Private Health Insurance Work Better for Consumers During the Coronavirus Public Health Crisis?

Slowing the spread of the novel coronavirus, or COVID-19, and ensuring affected patients receive treatment requires an urgent, coordinated, and comprehensive response from the federal government and states. Efforts must include improving testing capacity, supporting providers, addressing the lack of paid sick leave, and expanding access to Medicaid for the uninsured. At the same time, policymakers…