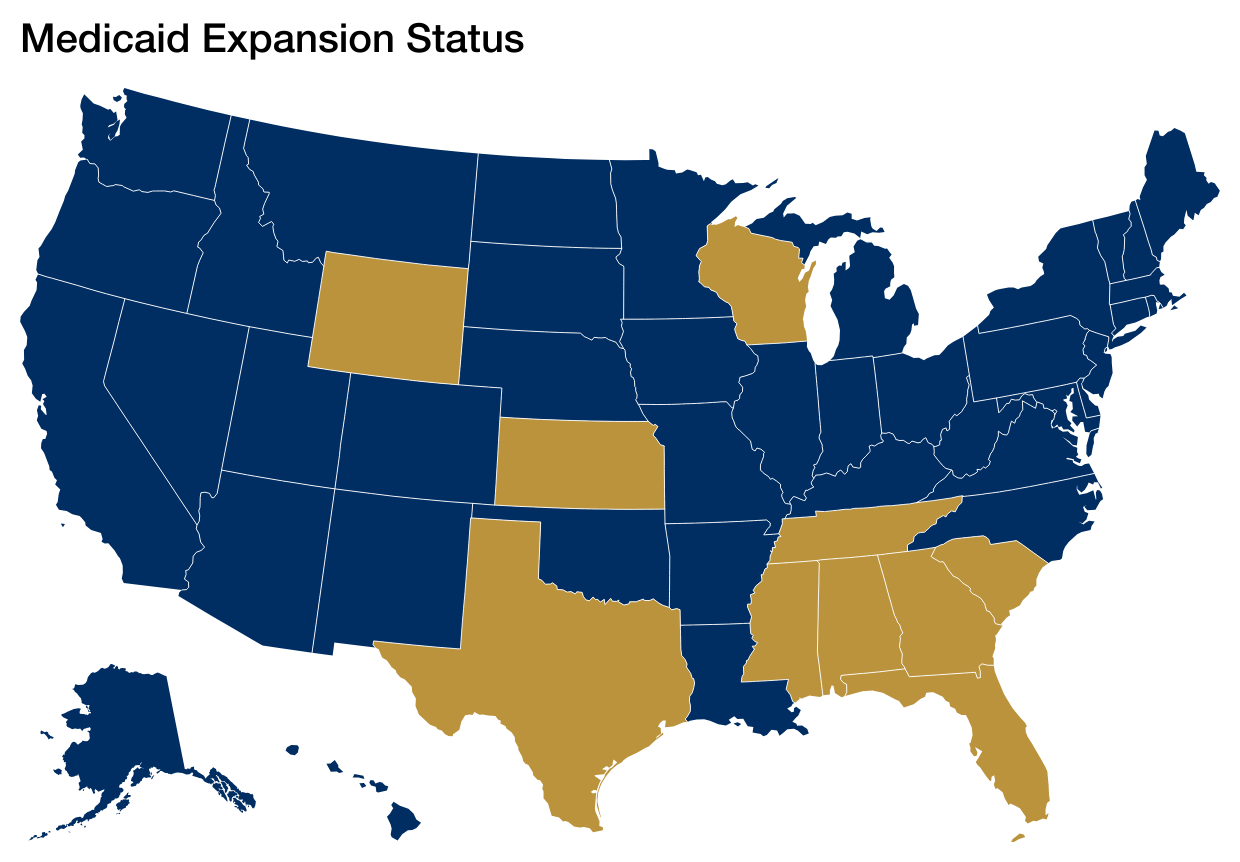

The federal budget reconciliation bill signed by President Trump, H.R. 1, made multiple cuts to the Medicaid program that were designed to deter states from expanding Medicaid. Ten states, mostly in the South, have not expanded Medicaid to low-income adults. Despite many attempts by proponents of large Medicaid cuts to lower the expansion match of 90%, that did not happen, and it remains available. However, other H.R. 1 policy changes will have significant impact on the fiscal status of states – and especially hospitals and other providers — as non-expansion states weigh the decision of whether or not to go forward. This is one of the most pernicious features of H.R. 1 since finishing the job of expanding Medicaid in the South is critical to realizing the goal of universal coverage as originally contemplated by the Affordable Care Act.

Our colleagues Edwin Park and Sabrina Corlette have written an extensive brief detailing all the Medicaid cuts and other health provisions included in H.R. 1. Another great resource on the many H.R. 1 changes affecting health care is the Kaiser Family Foundation’s timeline of changes in the law. Many of the provisions are targeted at existing expansion enrollees (most prominently the work reporting requirement, six-month renewals, more co-pays) which will result in millions of people losing coverage. But the most relevant provisions for states considering expanding Medicaid relate to financing. The most relevant H.R. 1 provisions include:

- Immediate moratorium on new Medicaid provider taxes or increases in existing taxes. States that recently expanded Medicaid, such as North Carolina, have raised revenue through increases in provider tax rates to finance their share of expansion costs. These increases are prohibited by H.R. 1 going forward.

- Immediate prohibition on certain existing provider taxes used to finance Medicaid with “uniformity waivers” subject to a potential transition period.

- New restrictions phasing down the size of permissible provider taxes used to fund Medicaid programs that only apply in expansion states starting in October 2027.

- An immediate cap on state directed payments to hospitals and other health care providers and a phasedown of existing payments starting in October 2028 with a lower cap on these payments in expansion states.

- Elimination of the federal “bonus” incentive for states to newly expand Medicaid in January 2026. For example, North Carolina, the last state to expand Medicaid, received a $1 billion federal bonus payment after expansion.

Overall, Medicaid expansion is still an option for the final ten states that have not expanded Medicaid with the federal government continuing to pick up 90 percent of expansion costs on a permanent basis. A substantial body of research, over 600 studies and counting, have shown the positive effects of Medicaid expansion such as gains in health coverage, improvement in access to care and health measures and economic benefits for both states and providers. However, state legislatures will have to weigh the benefits of expansion against the new restrictions on Medicaid financing that would otherwise be available for expansions and elimination of the federal bonus incentives for expansions that were enacted in H.R. 1.